Published: 10 December 2020

- Eurogas study shows policies supporting gas and its decarbonization, alongside growth in electricity, could greatly reduce the cost of achieving a net-zero carbon EU by 2050

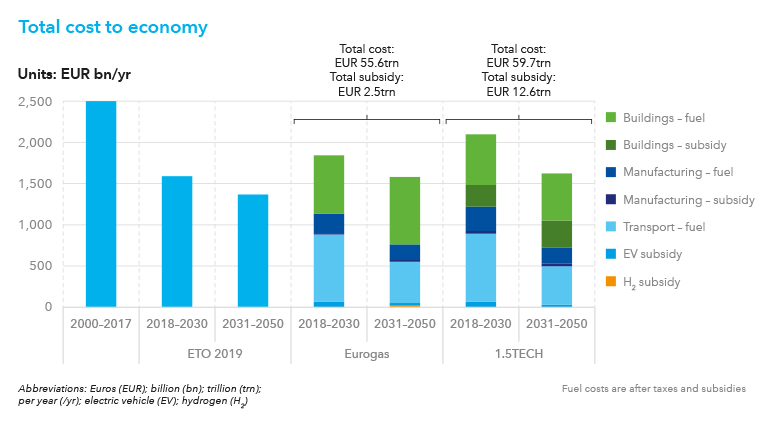

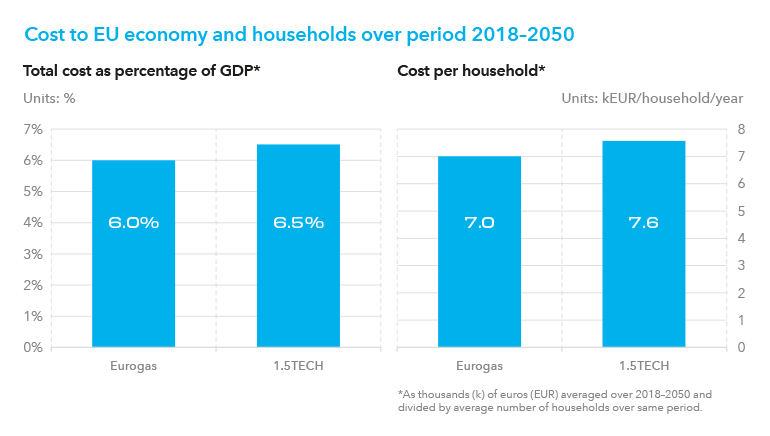

- A mixed-fuel strategy could save EUR 600 per household per year between 2018–2050, with major savings in decarbonizing heat for buildings

- Eurogas chief James Watson says results show EU must kick-start the clean hydrogen economy immediately, and that CCS is needed to achieve climate ambitions

- Eurogas is presenting the study to policymakers in the European Commission, the European Parliament, EU Member States, and other stakeholders and associations.

Achieving a carbon-neutral EU by mid-century will cost trillions of euros less if use of gas, increasingly decarbonized by carbon capture and storage (CCS), is continued alongside growing use of electricity in the transition.

This is a key finding in European Carbon Neutrality: The Importance of Gas, a Eurogas study commissioned from DNV GL. Eurogas represents the European gas wholesale, retail, and distribution sectors towards EU institutions.

The study predicts the outcomes of contrasting policy choices in Europe’s energy mix between now and mid-century to reach carbon neutrality. It is based on DNV GL’s Energy Transition Outlook (ETO), a model of global energy demand and supply to 2050.

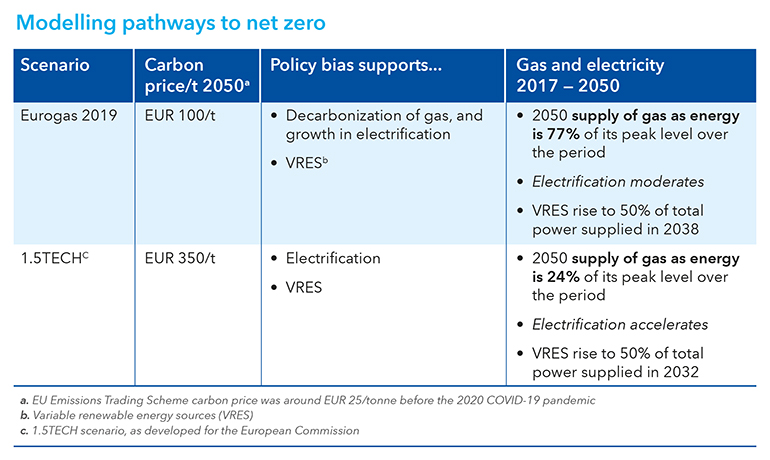

Eurogas commissioned DNV GL to use the company’s 2019 ETO model – which did not foresee EU carbon-neutrality in 2050 – to forecast trends under two scenarios that do make this assumption. In one of these scenarios, electrification is the strong driver towards a net-zero EU, and demand for oil and gas declines but remains in the picture. In the second scenario, gas plays a strong role, with demand for oil and gas in 2050 being twice as high as in the ‘strong electrification’ scenario. The findings are compared with two other transition pathways – Eurogas 2019 and 1.5TECH (Figure 1).

Figure 1: Key assumptions in the Eurogas 2019 and 1.5TECH models. The models forecast energy demand under different pathways to achieving full decarbonization of the EU energy system in 2050, with net negative emissions in power and manufacturing to offset unabated emissions.

Applying the ETO model in this way indicates that policies strongly favouring either gas decarbonization or strong electrification can lead to a net-zero EU. However, supporting a broad fuel mix is seen to offer a significantly more affordable transition for householders and taxpayers.