PERSPECTIVES

Oil and gas industry insightEurogas study sees combining gas, CCS, and renewables as a cheaper path to a net-zero EU than relying on electrification

Routes to reduce emissions from oil and gas production

Heating homes with hydrogen: proving the safety case

- Oil and gas

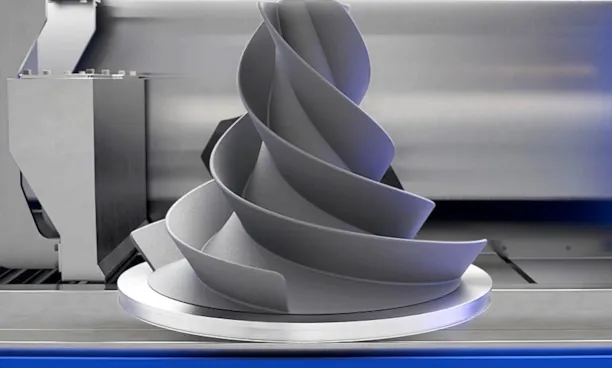

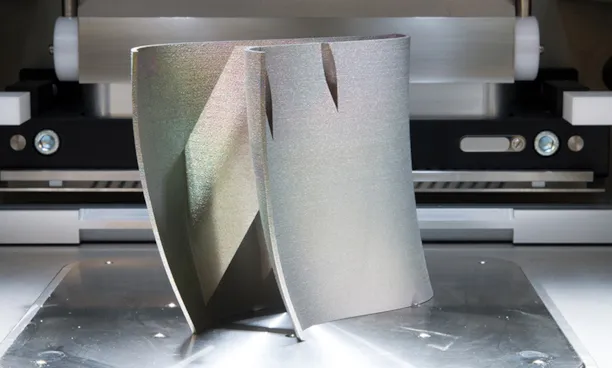

Certification can open minds to ‘printed’ parts, boosting oil and gas sector efficiency and decarbonization, says global manufacturer

Trust is a key to oil and gas sector use of metal parts made by additive manufacturing, says leading manufacturer Protolabs

- Oil and gas

Eurogas study sees combining gas, CCS, and renewables as a cheaper path to a net-zero EU than relying on electrification

Of the investment needed for gaseous energy networks in the Eurogas scenario for a net-zero EU by 2050, over 80% is to adapt them for hydrogen use.

- Oil and gas

Remote survey: A new normal for oil and gas

Oil and gas industry interest is surging in using remote survey technologies for more cost-efficient, safer, and lower-carbon certification, verification and inspection of assets and operations.

- Oil and gas

Where’s LNG investment heading?

DNV’s Energy Transition Outlook 2020 predicts a strong outlook for LNG, as natural gas becomes the world’s largest energy source.

- Oil and gas

Routes to reduce emissions from oil and gas production

Oil and gas companies are acting to reduce emissions from production to demonstrate prompt action on global warming.

- Oil and gas

Heating homes with hydrogen: proving the safety case

DNV’s HyStreet infrastructure is proving vital to the necessary safety tests, as part of the H21 project led by Northern Gas Networks and the UK Government’s Hy4Heat programme

- Oil and gas

Testing paves the way for hydrogen use in homes

Consumers and appliance makers will benefit from DNV tests to make hydrogen reliable and safe for heating and cooking

- Oil and gas

Trustworthy digital twins can power a more efficient future

TechnipFMC and DNV are developing a new approach to digital twins, to ensure the technology’s value meets expectations.

- Oil and gas

Reassuring the oil & gas and marine sectors over ‘printed’ parts

Processes to independently qualify or certify parts produced by additive manufacturing can unlock large markets, says the maker of the world’s fastest 3D printer.

- Oil and gas

The evolving oil and gas workforce

Progressive stances and steps on decarbonization and digitalization, coupled with openness to new opinions and ideas, can help companies to win the trust of tomorrow’s leaders.

- Oil and gas

Research identifies critical technologies for oil and gas in a transforming decade

Technology Outlook 2030 identifies which technologies will help the sector to meet efficiency, decarbonization, and safety challenges over the next decade.

- Oil and gas

Heating Dutch homes with hydrogen

A project led by gas and power networks operator Stedin aims to show that homes can be heated safely and efficiently with clean hydrogen.

- Oil and gas

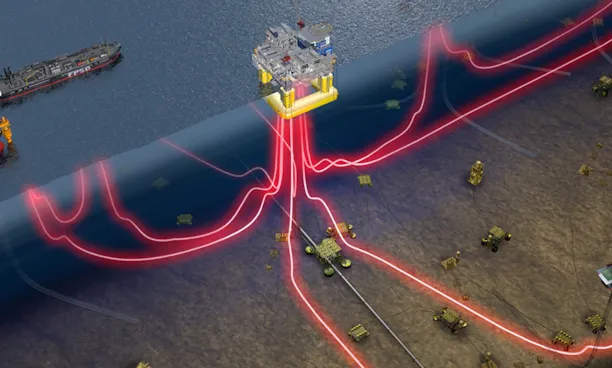

Standardization can boost subsea's prospects

There is scope for even more standardization to reduce costs for subsea parts, modules, and systems.

- Oil and gas

New digital twin concept could show real-time status of safety risk and operations

Probabilistic digital twins are a new idea for capturing uncertainty, the effect of new knowledge, and actual conditions, on operational performance and safety.

- Oil and gas

Probing human factors for safer, more sustainable oil and gas operations

DNV GL’s updated International Sustainability Rating System creates transparency on how business processes impact on key operational criteria.

- Oil and gas

Can printed parts make oil and gas operations smarter and greener?

Additive manufacturing — the more sophisticated, industrial equivalent of 3D printing — could become the most disruptive technology the oil and gas industry has ever seen for sourcing and using materials.

- Oil and gas

Machine learning can make mooring safer and more cost effective

Traditional ways of detecting and predicting mooring line failure have limitations. Machine learning now proves its power for identifying condition of mooring lines.

- Oil and gas

Petrobras puts people at the heart of its digital transformation

Petrobras, Brazil’s national oil company, is driving forward an ambitious digital transformation to speed up decision making to reduce cost, become safer, and be more productive and compliant with regulations.

- Oil and gas

Governments get serious about hydrogen

Governments worldwide are showing increasing interest in hydrogen as a clean energy carrier to complement electricity in decarbonizing national energy systems.

- Oil and gas

Meeting the challenge of China's dash for gas

The People's Republic of China's switch from coal to gas, to decarbonize its energy mix and tackle pollution under its Blue Sky policy, requires importing a lot more gas